“After consolidating and re-financing her loans over the years, Cindy owes $87,000 on the principal…”

“

After consolidating and re-financing her loans over the years, Cindy owes $87,000 on the principal and $42,000 worth of accumulated interest. She is four years away from retirement and her social security will likely be going into the hands of Ed Financial, who took over her loan from the federal government. Cindy is one of 40 million Americans strapped with student debt, many of whom will never be able to pay off their loans.

“College is a bad investment that only pays off if you don’t have to go into debt to get your degree,” she said. “Borrowing to get an education guarantees you will never get anywhere or have even the most basic aspects of the so-called ‘American Dream.’”

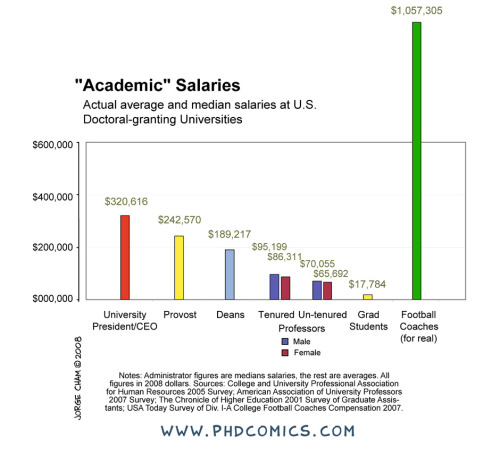

With the cost of higher education currently at 27 percent above the rate of inflation and continuing to rise, students are being forced to take out greater sums, which often double, triple, or even quadruple over the years as interest adds up. Meanwhile, school administrators are lining their pockets. A report from the Public Policy Institute this month correlated school executive pay to student debt. Examining the top 25 priciest state universities, Public Policy notes that the “student debt crisis is worse at state schools with the highest-paid presidents,” where administrative costs have dwarfed funds spent on scholarships by more than two to one.

”