Fed’s Fisher Admits “Fed Has Levitated Markets”, Warns Of “Signs Of Excess” | Zero Hedge

Fed’s Fisher Admits “Fed Has Levitated Markets”, Warns Of “Signs Of Excess” | Zero Hedge:

FOMC voting-member Richard Fisher is among the sanest voices in the Eccles Building asylum and he is once again sounding alarms that all is not well in US financial markets: *FISHER SAYS FED HAS ‘LEVITATED’ MARKETS, SEES SIGNS OF EXCESS IN FINANCIAL MARKETS Furthermore, Fisher notes The Fed can’t force companies to hire, and would like to see rate hikes as early as Spring 2015.

Hahaha “Levitates” it makes the Fed sound like a bunch of innocent stage actors instead of a group of aholes using taxpayer money to inflate the bottom lines of big companies and the wealthy at the expense of the middle class. Yes, ‘levitate’ is not the word I’d use for ‘inflated the economy to the largest bubble it has ever had and thrown the entire world economy on to the top of a precipice.’

But sure, we can pretend we’re wizards instead.

Visualizing The Triumph Of Hope Over Reality | Zero Hedge

Visualizing The Triumph Of Hope Over Reality | Zero Hedge:

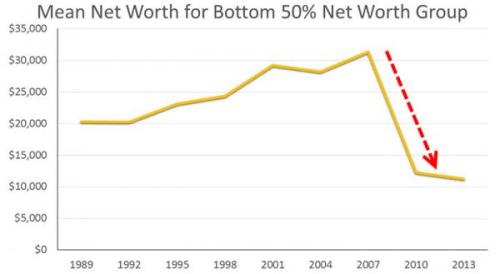

Remember when we talked about how TARP implicitly made risky funds safe by bailing out the banks? (After all, if we bailed them out for screwing up this time, then surely we’ll be able to bail them out next time.) Well, as was predicted by many a person with sense, the risky and fairly terrible assets on the market have been tanking the *real* value while our government waves a hand and says ‘all is well here.’ And the market believes them.

All is not well.